Welcome to CoorpID!

Access CoorpID APIs.

Know Your Customer (KYC) has turned out to be a lot more burdensome and costly than anyone in the financial services industry could possibly have anticipated when the first Anti-Money Laundering regulations came into force. CoorpID offers an innovative tool with which financial institutions can streamline and standardise their KYC data collection process and significantly reduce points of friction in the client outreach process. The platform helps banks and large corporations to easily structure and share KYC company information, across multiple entities.

We believe in further standardization of KYC information requests. This would increase the predictability of the process for the customer and the bank. Only collecting and updating the information once and then sharing this information with multiple banks results in huge time savings and thus also lower costs for the customer. A win-win situation for all parties.

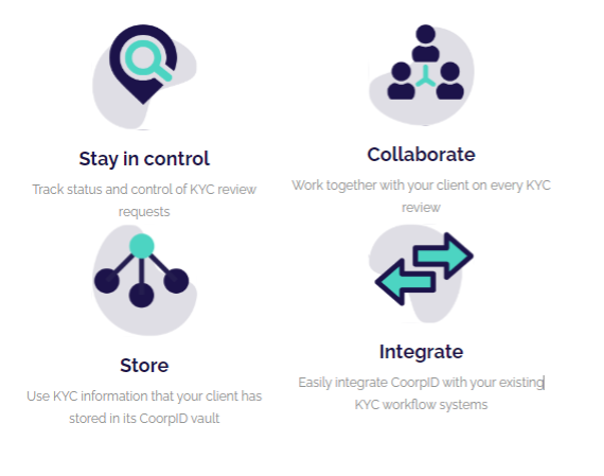

Users can access CoorpID through the browser (plug ‘n play) and it can easily be integrated into the bank’s existing workflow tools through a set of API’s.

Handle the whole client outreach information-gathering process in a highly efficient, well-structured and secure manner

Use the KYC information that your client has stored in its CoorpID vault as the starting point for your desktop research and thus minimise the client outreach

Send targeted information requests to clients to obtain the required KYC information for each individual corporate entity

Avoid communicating and exchanging confidential and sensitive information via email

Easily integrate CoorpID with your existing KYC workflow systems

Standardise your information requests using the best practices incorporated in CoorpID

Improve the KYC customer experience and customer journey

CoorpID was founded and initiated by ING in 2018. Our aim is to minimize the KYC regulatory burden so that financial institutions and large multinational corporations can focus on their core business. More info: www.coorpid.com